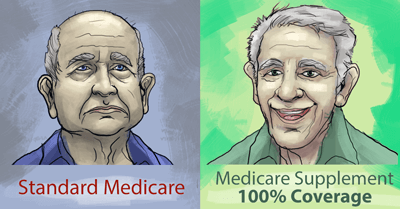

*100% saving on medical expenses does not include the cost of the optional Medicare Supplement Plan also known as Medigap.

"Out of pocket expenses" | Source: https://medicare.com/about-medicare/have-you-paid-out-of-pocket-before/

"Seniors' Out-of-pocket health costs can hit $350k, even with Medicare" | Source: http://www.newsweek.com/seniors-out-pocket-health-costs-hit-350k-medicare-579736

Trademarks utilized on our website belong to their respective owners and no implied or expressed endorsement of our website or services is intended. Through in-depth research and experienced editors we provide feedback about products and services. We are independently owned, and opinions expressed here are our own.

We are dedicated to bringing readers valuable information which can help them accomplish their financial and lifestyle goals. Our disclaimer is that this site does receive compensation for product reviews and referrals or purchases made through our links. This page is an advertisement/advertorial. The story depicted here is for demonstration purposes only and everyone's results may vary. We hope you find our online resource informative and helpful.

This site is in no way affiliated with any news source. This site contains affiliate and partner links. Any testimonials on this page are real product reviews, but the images used to depict these consumers are used for dramatization purposes only. This website and the company that owns it is not responsible for any typographical or photographic errors. If you do not agree to our terms and policies, then please leave this site immediately. All trademarks, logos, and service marks (collectively the "Trademarks") displayed are registered and/or unregistered Trademarks of their respective owners. Contents of this website are copyrighted property of the reviewer and/or this website.

The site is not affiliated with or endorsed by the United States government, the federal Medicare program or the website medicare.gov.